2551m deadline 2024|When to File : A List of BIR Tax Deadlines : iloilo BIR Tax Deadlines. WAIVER: Please note that this is just a basic listing and should not be taken as complete or accurate. Deadlines may change without prior notice. For a more . GASKEUNBET adalah link alternatif Gaskeun Bet slot gacor 10k yang paling mudah menang maxwin, login Gaskeunbet88 slot gacor 2024 pasti jackpot. reformal.ru Главная

2551m deadline 2024,The deadline for electronically filing and paying the taxes due thereon shall be in accordance with the provisions of existing applicable revenue issuances. Basis of Tax. The tax is based on gross sales, receipts or earnings except on insurance companies where .

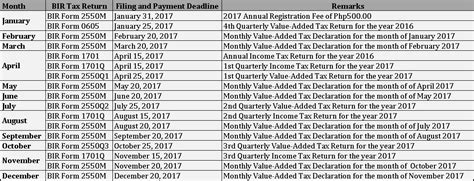

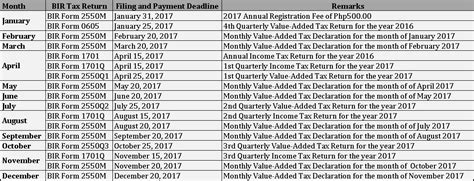

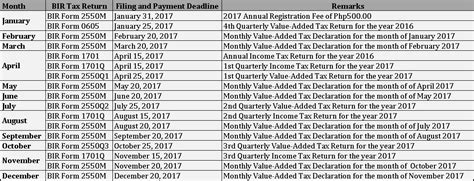

BIR Tax Deadlines. WAIVER: Please note that this is just a basic listing and should not be taken as complete or accurate. Deadlines may change without prior notice. For a more .

A simple guide to a list of tax deadlines as per provisions of the BIR. Written by Kaye Estanislao. Updated over a week ago. Percentage Taxes. Quarterly (2551Q) - Every . Here are some of the tax deadlines for the month of July: July 20: Filing of 2550M, 2551Q, 2307. July 20, 2018 is the deadline for filing .The said RMC provides that for transactions beginning 01 January 2023, VAT-registered taxpayers will no longer be required to file the Monthly VAT Declaration (BIR Form No. .

This Tax Alert is issued to inform all concerned taxpayers on the extension of filing and payment of returns, and submission of reportorial requirements due on September 26, 2022.

BIR Form No. 2551m Filing Help. 1. Familiarization of the form. a. Entry Fields. These colored white text fields or option buttons are used to enter data. b. Display Fields. .Procedures in accomplishing the BIR Form No. 2551M. Steps. Hint: Use tab to move to the next field. 1. Item 1 will be defaulted to either calendar/fiscal depending on your .

the Electronic Filing and Payment System (EFPS), the deadline for e-filing and e-paying the tax due thereon shall be five (5) days later than the deadline set above. On April 25, on the deadline of filing the Quarterly Percentage Tax Form, the BIR released RMC 26-2018 which has the new 2551Q form and the submission .Fill 2551m Deadline, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller Instantly. Try Now!By: Paul Joseph S. Abenojar. Paul Joseph S. Abenojar Analyst KPMG in the Philippines. Paul Joseph S. Abenojar is an analyst from the Tax Group of KPMG in the Philippines (R.G. Manabat & Co.), a Philippine partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a .

Deadline for manual filers: 0605: Payment Form Annual Registration: January 31: 1601-C: . Valid until 10/21/2024; Agency Links. Get latest news and information from the following agencies: Bureau of Internal Revenue (BIR) Social Security System (SSS) Pag-IBIG Fund; Securities & Exchange Commission (SEC)When to File : A List of BIR Tax Deadlines Deadline for manual filers: 0605: Payment Form Annual Registration: January 31: 1601-C: . Valid until 10/21/2024; Agency Links. Get latest news and information from the following agencies: Bureau of Internal Revenue (BIR) Social Security System (SSS) Pag-IBIG Fund; Securities & Exchange Commission (SEC)

when is the deadline of 1601EQ for 1st Q 2024? thanks po Under the Tax Reform for Acceleration and Inclusion (TRAIN) Law and Revenue Memorandum Circular (RMC) No. 5-2023, VAT-registered taxpayers are no longer required to file monthly VAT returns (BIR Form No. 2550M) pertaining to transactions that occurred beginning January 1, 2023. Filing and Paying Taxes on eFPS Under Ease of Paying Taxes (RMC No. 87-2024) Online Sellers Get Extra Time to Register for Taxes as BIR Extends Deadline (RMC 79-2024) Clarifying Invoice Requirements for VAT and Non-VAT (RMC 77-2024) BIR Extension of Deadlines due to Typhoon Carina; What is Sales Tax? Instead of using the 2551M and filing it monthly, you’ll use the 2551Q. . Online Sellers Get Extra Time to Register for Taxes as BIR Extends Deadline (RMC 79-2024) Clarifying Invoice Requirements for VAT and Non-VAT (RMC 77-2024) BIR Extension of Deadlines due to Typhoon Carina;BIR Form No. 2551M: Monthly Percentage Tax Return Description: This return is to be accomplished and filed by any of the following: 1. Persons whose gross annual sales and/or receipt do not exceed P550,000 and who are not VAT-registered persons. 2. Domestic carriers and keepers of garages, except owners of bancas and owners of animal-drawn .

The deadline for electronically filing and paying the taxes due thereon shall be in accordance with the provisions of existing applicable revenue issuances. Rates and Bases of Tax A. On Sale of Goods and Properties - twelve percent (12%) of the gross selling price or gross value in money of the goods or properties sold, bartered or exchanged. .The Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the Philippine tax laws and their implementing regulations and revenue issuances, including information on BIR Programs and Projects. It also contains copy of the Tax Code, BIR . The schedule of LET, CPALE, CELE, CLE, NLE, MTLE, PLE, SWLE, PT-OT, VLE, ECE-ECT, REE-RME, RadTech, MELE, ALE, among other board exams were published through a PRC Resolution entitled “Schedule of Licensure Examination for the Year 2024”.This includes the date of exams, testing venue(s)/location(s), the opening of .2551m deadline 2024 When to File : A List of BIR Tax Deadlines Any forms that will be sent beyond that filing deadline will be transmitted within the next business day. How to file? Just like any other tax form, you can e-file and e-pay forms for your clients using JuanTax. . 1701, .The Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the Philippine tax laws and their implementing regulations and revenue issuances, including information on BIR Programs and Projects. It also contains copy of the Tax Code, BIR . At this time, registration is open for all students for the entire 2024–25 testing year. All deadlines expire at 11:59 p.m. ET, U.S. . Registration Deadline Deadline for Changes, Regular Cancellation, and Late Registration** Aug 24, 2024: Aug 9, 2024: Aug 13, 2024: Oct 5, 2024: Sept 20, 2024 Register: Sept 24, 2024: Nov 2, 2024: Oct 18 .

BIR Form No. 2551M Monthly Percentage Tax Return Vat/Percentage Tax Return - This BIR return shall be filed in triplicate by the following: Persons whose gross annual sales and/or receipt do not exceed P1,500,000 and who are not VAT-registered persons; Domestic carriers and keepers of garages, except owners of bancas and owners of .

The Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the Philippine tax laws and their implementing regulations and revenue issuances, including information on BIR Programs and Projects. It also contains copy of the Tax Code, BIR .

Providing Transitory Provisions for the Implementation of the Quarterly Filing of VAT Returns Starting January 1, 2023 Pursuant to Section 114(A) of the National Internal Revenue Code of 1997 (Tax Code), as Amended by Republic Act (R.A.) No. 10963, Otherwise Known as the "Tax Reform for Acceleration or Inclusion" or the "TRAIN Law"

Under Republic Act No. 10963, also known as the Tax Reform for Acceleration and Inclusion (also known as TRAIN Law), 2551Q forms shall be filed every 25th day after the taxable quarter.. Please take note that your tax forms will be sent electronically to the BIR until 9pm. Any forms that will be sent beyond that filing deadline will be transmitted .

2551m deadline 2024|When to File : A List of BIR Tax Deadlines

PH0 · When to File : A List of BIR Tax Deadlines

PH1 · Understanding and Filing BIR Form 2551Q

PH2 · Procedures in accomplishing BIR Form No. 2551M

PH3 · Filing for the 2nd quarter: 1601

PH4 · Filing and payment of BIR Forms 2550M, 2550Q and

PH5 · DLN: PSIC: Monthly Percentage 2551M

PH6 · Brand New 2551Q Form (Quarterly Percentage Tax) with 8% Opt In

PH7 · Brand New 2551Q Form (Quarterly Percentage Tax) with 8% Opt

PH8 · BIR Tax Deadlines

PH9 · BIR Form No. 2551M

PH10 · BIR Form 2551M Help Page

PH11 · 2550